Money is the only thing which helps you to achieve many things in the world. But, managing money is the most difficult thing many people cannot follow. Here in this article am going to tell you the most useful tips to save your money without sacrificing your needs.

1. The 24-hour rule

Rich people don’t go for shopping emotionally. The postpone their impulsive shopping for 24 hours. They will find whether it is a need or want before buying any expensive thing.

2. Avoiding Cards

Rich people prefer cash than cards. Credit cards are not so friendly for the bills. Making a payment through money will help you to track expenses.

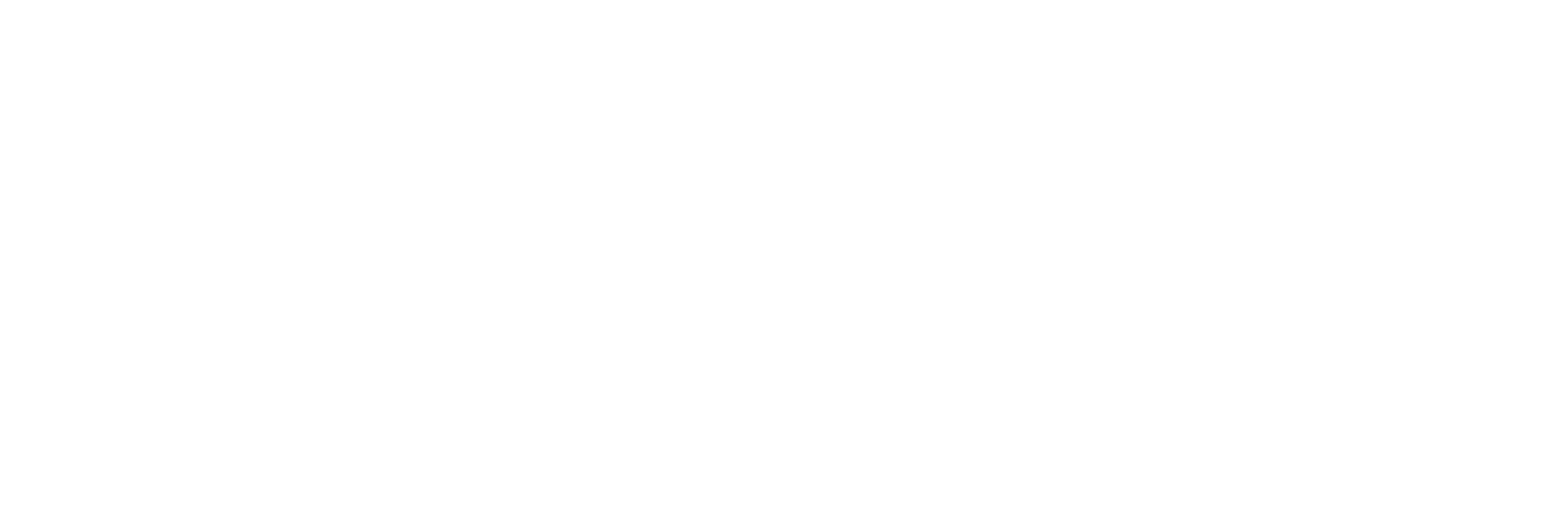

3. Setting a monthly budget

Set a budget as per your income standards per month. This will help you to follow all the costs. The budget rule should be 50/30/20, where 50% of your income should go to your household expenses and 30% income should be your wants and entertainment, and the remaining 20% should be your saving.

4. Spending money rightly

Spend on things that matter to you. Financially successful people will spend money on the things that will help them to earn. They know where to spend and where to stop. Buying a small car will save some money for you but buying a reliable vehicle which you can effort will save, money in the long run.

5. Time Management

Financially successful people will value time more than money. Getting a home delivery, hiring laundry, buying a house near to your office will only reduce your mental stress. Spending money on hiring services will gives your lot of time to invest.

6. Experience VS Things

Instead of spending lots of money on valuable things to buy rich people spend more money to have life long exposures. Traveling and exploring the world will give more knowledge than purchasing a diamond necklace.

7. Bills first and the rest later

People who are good at money management will always prefer to pay the bills first. I follow this point a lot. Paying your bills first will always avoid the fines. This will give you a clear picture of the money you have left with, and you can plan for the rest.

8. Making a list to buy things on sales

Shopping on the sale of will makes you spend a lot of money unnecessarily by purchasing the items which you don’t use later. So, making a list to but the stuff on the sale will help you to save a lot of money.

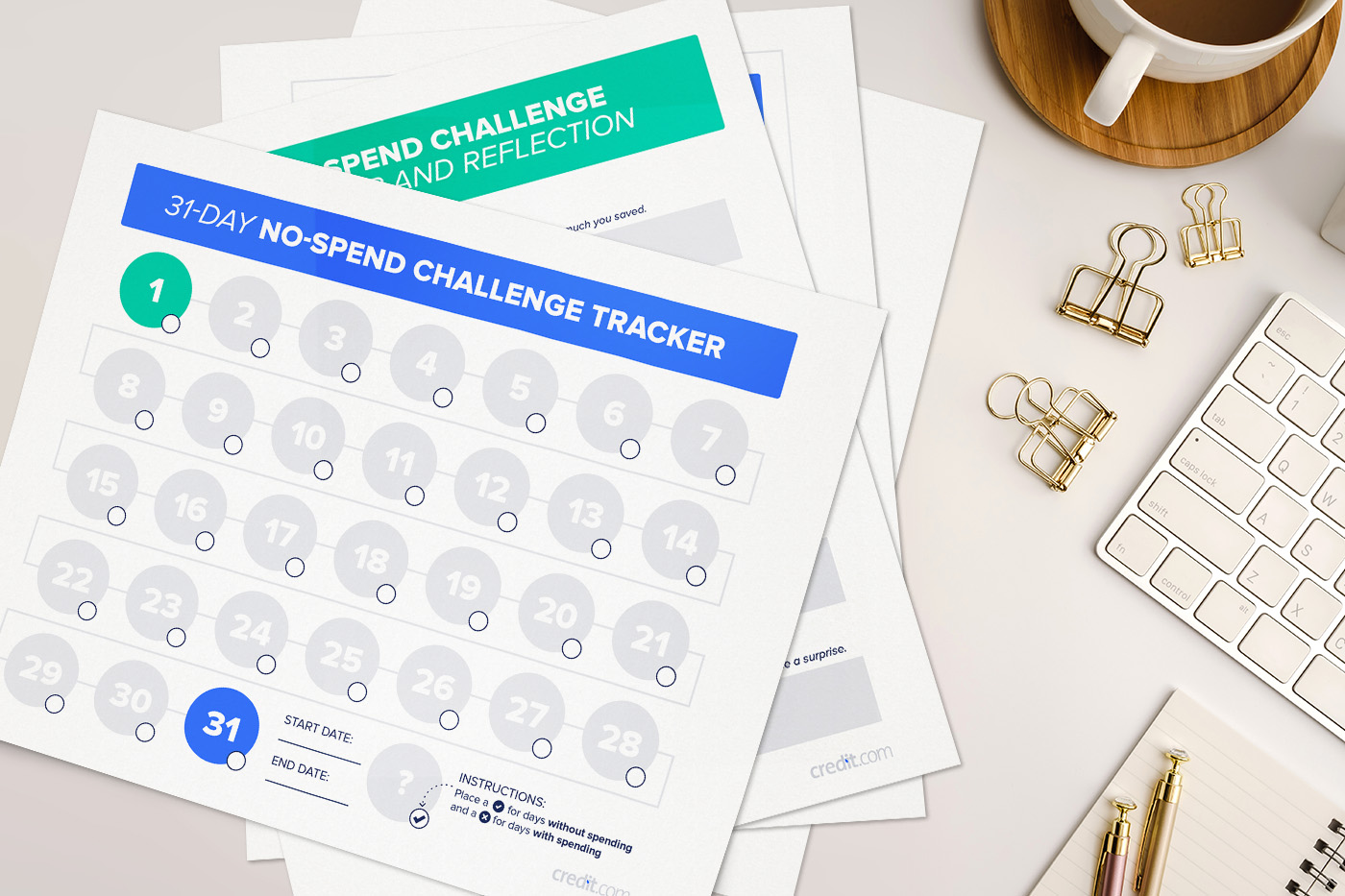

9. Having “No” spending days

Unless there is an unavoidable emergency people who are good at saving will try to avoid spending on certain days in a week or on the weekends. Trying to eat at home is one of the best things that you can do to save money.

10. Investing in yourself

Buying the things that will add the value for life is more important than buying random stuff.

11. Saving your change makes a lot of difference

Financially influential people will always collect their coins and spend this amount to something valuable. Every penny saved is a penny earned!.

12. Repair things before discarding them

Before discarding anything think about repairing them. You can always save money in this way.

Do let me know what the money management tips you follow in the comment section is.